Commercial Property Insurance

Get your commercial property insured today!

What is covered by standard Commercial Property Insurance in Florida?

Commercial Property insurance protects your company’s physical assets from fire, explosions, burst pipes, storms, theft and vandalism. Earthquakes and floods typically aren’t covered by commercial property insurance, unless those perils are added to the policy.

How much does commercial property insurance cost?

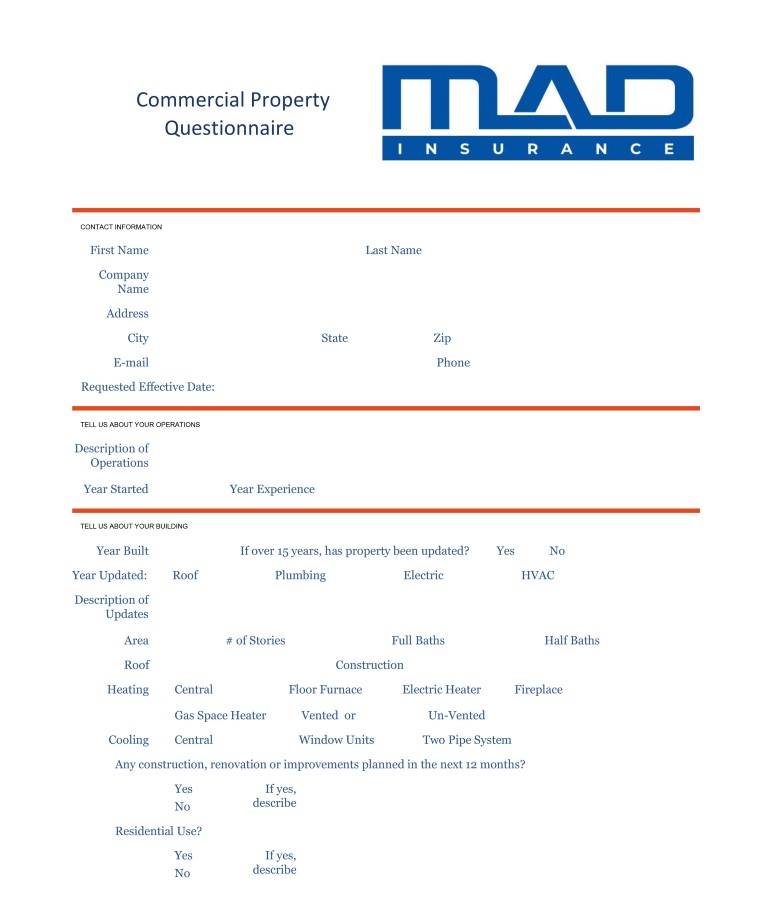

Determining how much you’ll pay for commercial property insurance largely depends on the value of all of your business assets, including your building. Other factors that determine your premium are based on risk, including:

- Location. Is the area prone to storms and other natural disasters?

- Construction. Is your building constructed with fireproof materials? Does it have new or upgraded electrical wiring, plumbing and HVAC?

- Occupancy. What is your industry? A realtor’s office generally carries less risk than a restaurant or repair shop.

- Fire and theft protection. How far is the nearest fire hydrant and fire station? Does your business have a fire alarm and/or sprinkler system? How about a security system?

What does Commercial Property Insurance in Florida cover?

Commercial Property Insurance covers your building, everything in it and just outside of it, including:

Computers

Furniture and equipment

Exterior signs

Fence and landscaping

Important documents

Inventory

Others’ property

To learn more about protecting your business property when the unexpected happens, contact one of our insurance experts at MAD Insurance.

Get in Touch

9050 Pines Blvd, Ste. 415-418

Pembroke Pines FL 33024

2440 SE Federal Hwy. Ste B Stuart, FL 34994

Hours of Operation

MONDAY - FRIDAY

9:30AM - 6PM

SATURDAY & SUNDAY

By appointment only

We are available 24/7 via text